We use cookies to enhance your experience

Our cookies dont collect personal identifiable information about you. We dont share cookie information with third parties. You agree to our use of cookies to improve site functionality and analyse usage. For more information please see our Privacy Policy.

- Solutions

- Point-of-Sale

-

- Mobile Solutions

- UPay AppMember payment app

- QR CodesScan, Order & Pay

- Order AheadChoose items, pay and collect at selected time slot

- Event ManagementEfficient event management with meal choice and payment options

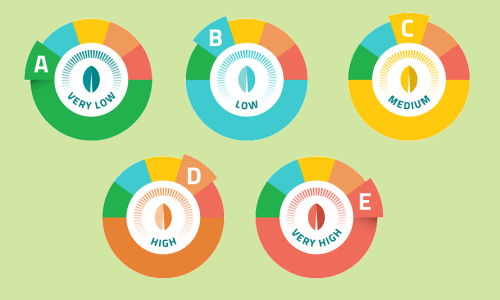

- Nutrition & AllergensAllergens and nutritional value for anything on your menu

- EnvironmentalBottle & can recycle schemes, carbon footprint value

- Operational Management

- Operational ManagementCustomisable automated reports

- IntegrationAPI solution to transfer data to existing systems

- Inventory ControlInventory control across multi site locations

- Loyalty & PromotionsPromotions, discounts, push messaging, in-app messaging

- Menu ManagementEasy till set up, instant amends, menu personalisation

- Point-of-Sale

- Sectors

-

-

SECTORS

Uniware excels by tailoring its software to clients diverse electronic point-of-sale system requirements.

-

-

- Customer Support

-

-

SUPPORT

Client support 24 hours a day, 7 days a week, 365 days a year

-

-

- News

- About

-

-

ABOUT

Intuitive point-of-sale solutions and reporting tools for driving efficiency, growth, and customer satisfaction.

-

-

- Contact